For the tax years 2017 through 2019 you can claim 30 percent of the cost of your solar water heater system which includes the cost of installation.

Tankless water heater tax refund.

Gas oil or propane.

Yes if it meets the requirements you can get up to a 300 tax credit for 2015.

The residential energy property credit is nonrefundable.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

150 for any qualified natural gas propane or oil furnace or hot water boiler.

At the time this article was published tankless water heaters appear to be eligible for federal tax credits for energy efficiency.

But the value of the tax credit is scheduled to decrease over time.

But there is no tankless heater tax credit.

Of course any qualifying tankless water heater installed this year would also qualify on taxes due in april 2021.

30 for systems placed in service by 12 31 19.

For the tax year 2020 the credit drops to 26 percent and for the tax year 2021 the credit drops to 22 percent.

You could be eligible for an energy efficient home improvement tax credit on as much as 30 of the cost including installation with no upper limit.

The energy star label is now available for electric heat pump water heaters as well.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

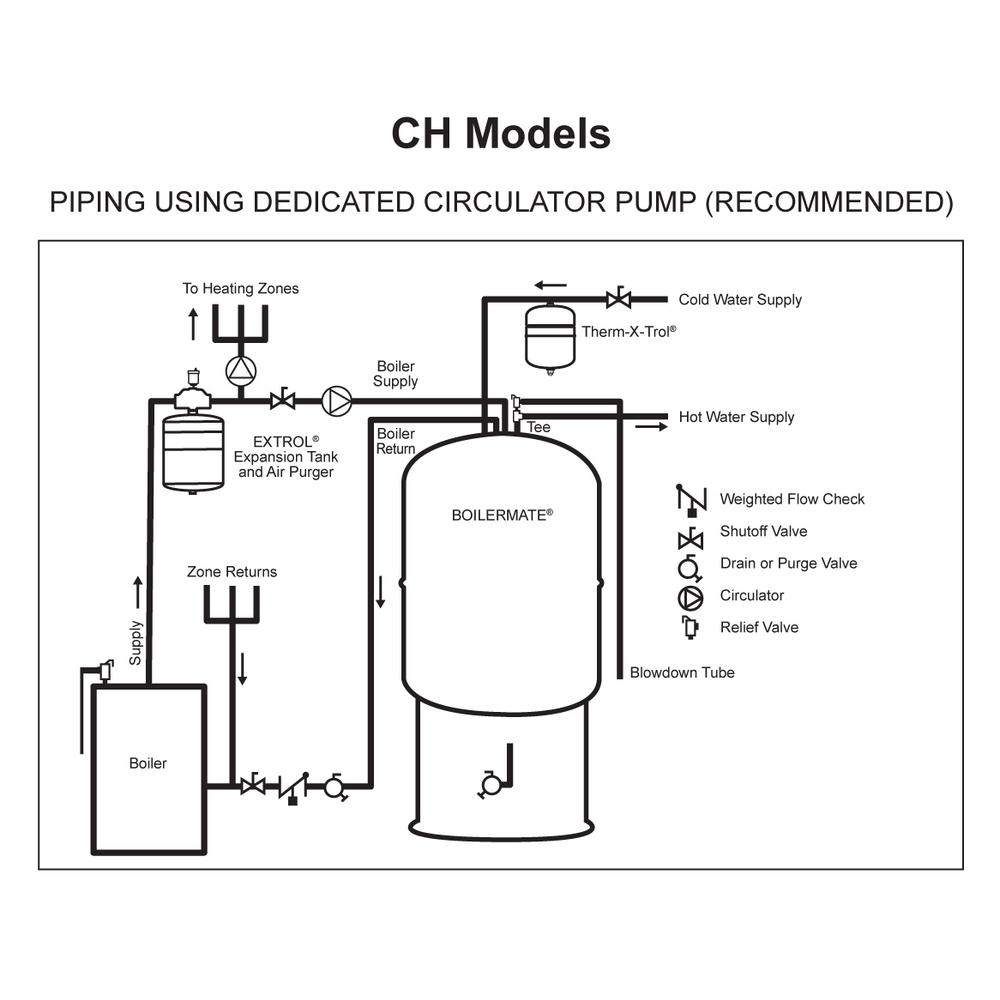

Energy factor 0 82 or thermal efficiency of at least 90.

How much of a credit can i claim on my tax return for a new solar hot water heater.

That means if you installed a qualifying tankless water heater last year you could get the credit on the return you file in 2020 for 2019.

Federal income tax credits and other incentives for energy efficiency.

Of that combined 500 limit a maximum of 200 can be for windows.

Requirements for non solar water heaters.

Energy factor 2 0.

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero.

How much of a tax credit can i claim.

Government offers a tax credit and or rebate for those who switch out their water heaters to new energy efficient models.

300 for any item of energy efficient building property.

Please see energy star federal tax credits non solar water heater.

Did you know that the u s.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

The credit amount for gas oil propane water heaters including tankless units is 300.

.png?width=495&name=Hot%20Water%20Fixture%20(1).png)