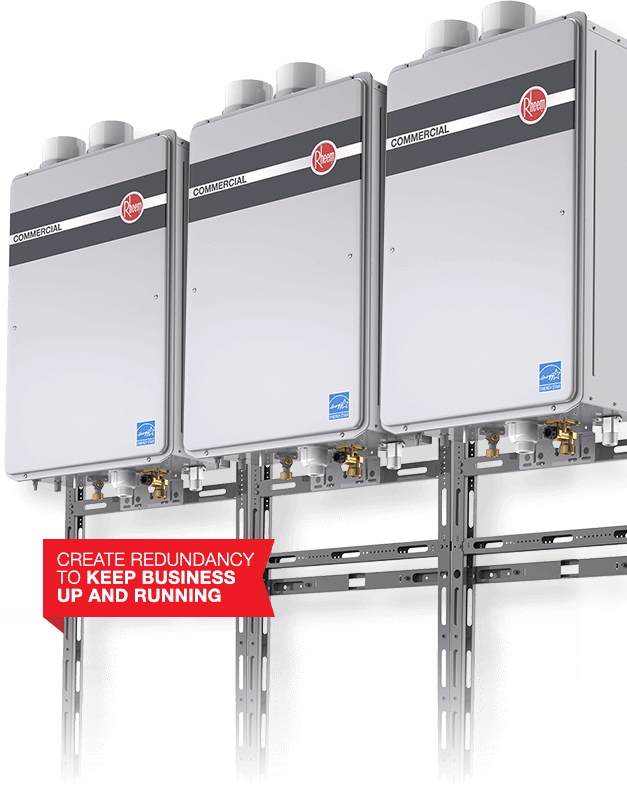

A tankless water heater tax credit is a government s tax credit to citizens who take advantage of switching to a more energy efficient tankless hot water heater.

Tankless water heater oregon tax credit.

Tankless water heater tax credits are often part of an initiative to improve a nation s overall carbon footprint or lower average energy use through the tax code.

Tax credit eligibility requirements for each device are described in the retc administrative rules ors 469b 100 118 and ors 316 116.

225 state tax credit for ef of 82 849.

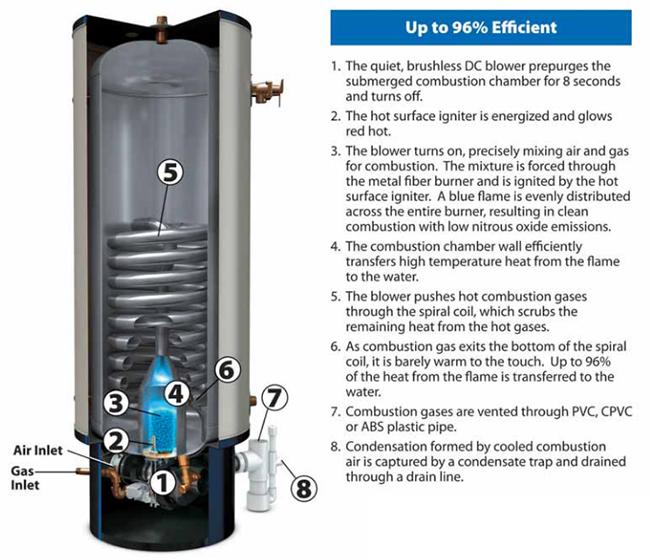

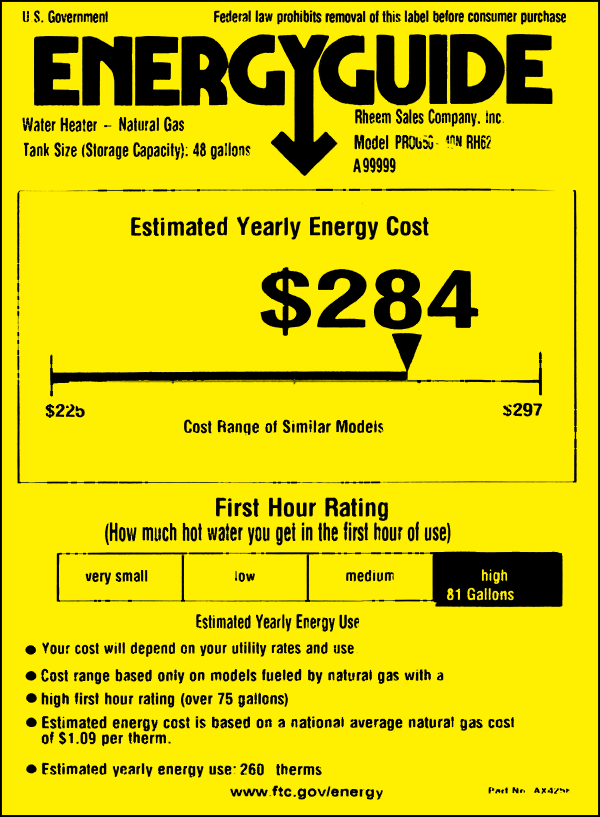

The energy star label is now available for electric heat pump water heaters as well.

For a tankless unit to qualify it must have a uniform energy factor uef of at least 0 82 all rinnai condensing tankless water heaters and the v94xi non condensing tankless water heater qualify.

The credit amount for gas oil propane water heaters including tankless units is 300.

That means if you installed a qualifying tankless water heater last year you could get the credit on the return you file in 2020 for 2019.

300 state tax credit for tier 1 heat pump water heaters.

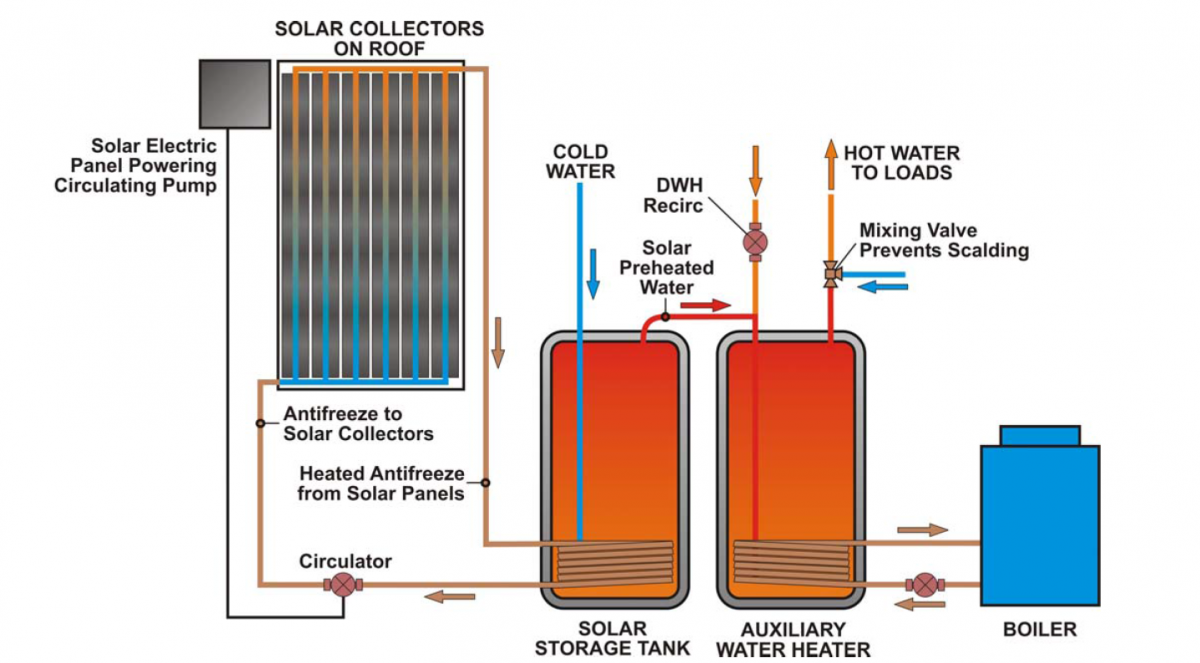

In addition homeowners may qualify for a 150 us federal tax credit with a an installed rinnai condensing boiler.

600 state tax credit for tier 2 heat pump water heaters ge rheem.

The state of oregon is offering a tax credit for the installation of gas tankless water heaters.

The non business energy property tax credit has been extended through 2020 and made retroactive to cover 2019.

245 state tax credit for ef of 85 or more.

These types of hot water heaters have been around for a while and many models offer a less energy consuming option for keeping a home supplied with hot water.

The state of oregon is offering a tax credit for heat pump water heaters.

.jpg)